Introduction

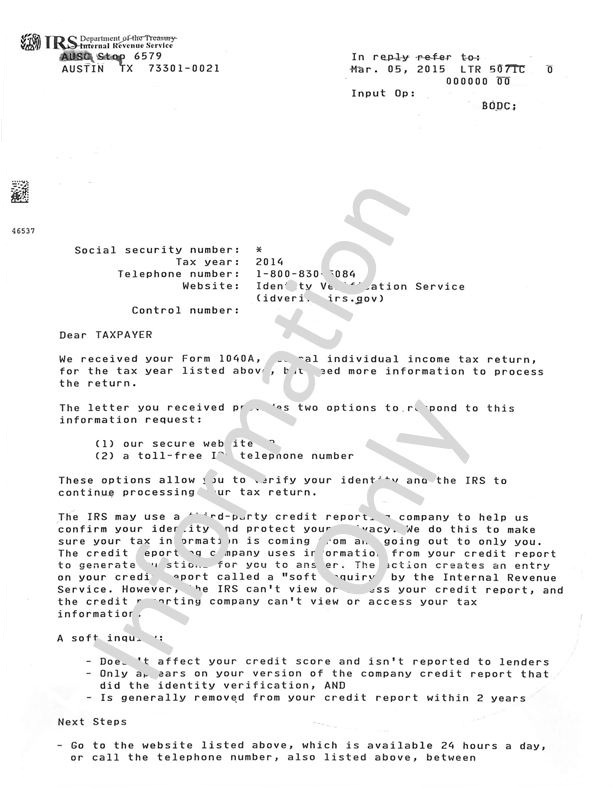

When the Internal Revenue Service receives a tax return that includes your name and tax identification number and has reason to suspect fraud, it will send you a 5071C letter. You will be asked to verify your identity via an online process after receiving Letter 5071C. Someone may have filed a false tax return using your identity and Social Security number or Individual Taxpayer Identification Number if you received a 5071C letter and you haven't filed. To prevent additional fraudulent activity, you must validate your identity and confirm that you may be a victim of identity theft.

What To Do If The Return Wasn't Yours

If the Internal Revenue Service has contacted you about a potential false return, additional steps should be taken to safeguard your identity. Put a fraud warning on your account by contacting one of the three credit reporting agencies (Equifax, Experian, or TransUnion). Once you report fraud to one agency, you must do so again to the other two. As an additional resource, AnnualCreditReport.com allows you to request free copies of your credit reports every year. Check your credit records for evidence of unauthorised account openings. Do not wait to close the accounts. Freezing your credit will prevent someone from opening new accounts in your name using your personal information. To swiftly challenge any illegal charges with your bank, you should check your accounts for any signs of fraud. If you want to ensure the security of your banking and investment accounts, change the passwords.

What You Need To Do Immediately

Visit our confidential Identity Verification Service now. It's always on hand, never slows down, and has a high level of security. To authenticate your identification, you must first register with the website. You should probably check the website and get the paperwork ready if you want to write something. To do this, make sure you have a duplicate of the 5071C or 6331C letter you received and a duplicate of your tax return for the year specified on the note. By checking a box on their website, you can let the government know that you didn't bother filing an income tax return.

Why Am I Getting This Letter?

A false tax return could be filed under your name and Social Security number or Individual Taxpayer Identification Number (ITIN) if you didn't submit one. Immediately verify that you may be a victim of identity theft by contacting us on the website above if you did not file an income tax return for the year in question. If you have already filed your taxes, please contact us through the above link so we can verify your identity, release your refund, or credit any overpayment to your 2019 due tax payment.

Why Would Someone Else Use My Name To File A Tax Return?

The only information required to submit a tax return is a taxpayer's name, SSN, and birth date. A thief might quickly get their hands on your long-awaited tax refund or, even worse, issue credit cards in your name and run up huge bills as you watch helplessly. It's a free-of-charge, toll-free line. Your IRS ITIN is exclusively used for identity verification. Further, no other tax data is accessible beside the refund status.

If you overpaid your taxes this year but want a refund or to put the money toward next year's estimated taxes, it might take up to 9 weeks from the time you verify your identification until you receive the cash or credit. In the event of any other problems, however, you may be sent a note requesting additional information before a refund is issued. The Internal Revenue Service may need you to visit your local IRS office for identity verification if they cannot do it over the phone.

How Do Criminals Get My Tax Information?

Unfortunately, seasoned criminals with tax-related motives have various methods for accessing taxpayer data. The IRS has stated that phishing email scams, bogus IRS phone calls, and internet data breaches are typical ways criminals obtain personal information.

What If I Did Not Receive The 5071c Notice, But The Irs Indicates That I Had Already Submitted My Tax Return?

If you submit your taxes electronically, you may get a rejection message saying that the IRS has already received a return with the same name. To report identity theft to the IRS, fill out Identity Theft Affidavit (Form 14039) or call 1-800-908-4490. Identity theft is never pleasant news, but if you find out immediately, you may take steps to prevent further damage to your finances and move on without delay.

Conclusion:

If the IRS suspects that a tax return filed in your name is a forgery, they will send you a letter requesting that you prove your identity by completing and returning Form 5071C. There will be instructions on what to do next and what form and year of the tax return are at issue in the letter. Your identity can be checked over the phone or online. If those don't work, you'll need to visit a local office to prove who you are in person. You should report the incident to the credit reporting agencies and the Federal Trade Commission (FTC) if the return you're being contacted about isn't yours.