Navigating the complexities of tax forms can be a daunting task for beginners. Understanding your obligations, knowing which forms to file, and decoding the jargon can easily become overwhelming. This guide is designed to simplify the process, offering a clear, concise introduction to the myriad of tax forms you might encounter. Whether you're an independent contractor, a small business owner, or an individual taxpayer, this guide aims to demystify the tax filing process. Through straightforward explanations and step-by-step walkthroughs, we'll help you gain the confidence to tackle your taxes head-on. Our goal is to equip you with the knowledge and understanding needed to ensure that tax season becomes a less stressful, more manageable part of your year.

The Basics of Tax Forms:

Understanding the basics of tax forms begins with recognizing the most common types. The Form 1040 is the standard federal income tax form used by individuals. It's where you report your income, deductions, and credits to determine the amount of tax you owe or the refund you're entitled to receive. For those who are self-employed or have additional income streams, such as from investments or rental properties, Schedule C and Schedule D attachments may be necessary. These schedules help outline specific income types and expenses, providing a more detailed view of your financial picture. It's crucial to familiarize yourself with the requirements of each form to ensure accurate and compliant tax filings.

Different Types of Tax Forms:

- Form W-2: This form is used to report wages, tips, and other compensation paid to employees by their employers. It outlines the total amount of wages earned with the corresponding tax withholdings for the tax year.

- Form 1099: There are several types of Form 1099 used to report various types of income received outside of traditional employment. These forms include 1099-INT for interest income, 1099-DIV for dividend income, and 1099-MISC for miscellaneous income such as freelance work or rental income.

- Form 1040-ES: This form is used to make estimated tax payments if you have income that isn't subject to withholding or if the amount of tax withheld isn't enough to cover your tax liability.

- Form 8863: This form is used to claim education credits for qualified expenses paid for higher education, such as tuition and fees.

- Schedule A: This schedule is used to itemize deductions, including charitable contributions, mortgage interest, and state/local taxes paid.

- Schedule SE: This schedule is used to calculate self-employment tax for those who are self-employed.

Understanding Your Tax Obligations:

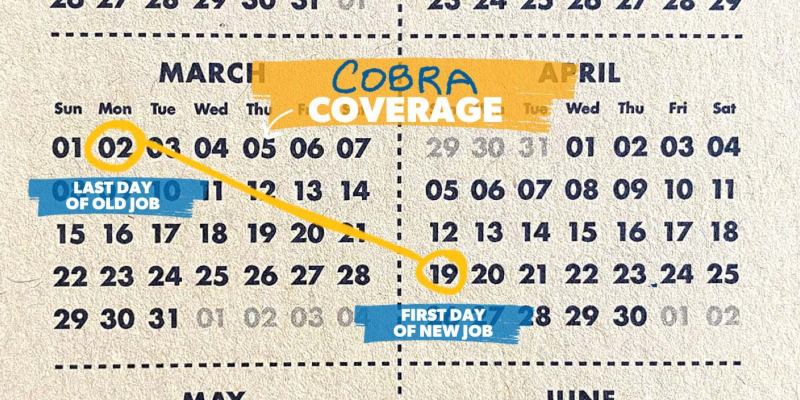

When it comes to taxes, it's essential to understand your obligations as a taxpayer. This includes knowing which forms you need to file and when they are due. Failing to meet these obligations can result in penalties and interest charges, so it's crucial to stay on top of your tax responsibilities.

Individual taxpayers are typically required to file their federal income tax return by April 15 each year. However, this deadline may be extended if you file for an extension and pay any estimated taxes owed by the original due date.

Step-by-Step Guide to Filing Your Taxes:

- Gather all necessary documents and forms: This includes your W-2, 1099 forms, and any other relevant documents such as receipts for deductible expenses.

- Choose the appropriate tax form: Depending on your income sources and filing status, you'll need to choose the right tax form for your situation.

- Fill out personal information: Make sure to enter your personal information accurately, such as your name, Social Security number, and filing status.

- Report income: Enter all sources of income for the fiscal year, including wages, interest, and investment income.

- Claim deductions and credits: Deductions and credits can help reduce your taxable income or even increase your tax refund. Be sure to claim all applicable deductions and credits.

- Calculate your taxes owed: Using the appropriate tax tables or tax software, calculate your total taxes owed for the year.

- File and pay any remaining taxes due: Once you've completed all necessary forms and calculations, it's time to file your tax return and pay any remaining taxes owed by the deadline.

Tips for Avoiding Common Mistakes:

- Double-check your information: Make sure all personal information, such as your name and Social Security number, is entered correctly. Simple mistakes can lead to processing delays or even result in penalties.

- Organize your documents: Keep all relevant tax documents in one place to make it easier to find what you need when filing your taxes.

- Review for accuracy: Before submitting your tax return, review all information for accuracy. This includes double-checking calculations and verifying that all deductions and credits are correctly claimed.

- File on time: Avoid late filing penalties by making sure to file your tax return on or before the deadline.

Resources for Further Assistance:

If you still have questions or need assistance with filing your taxes, there are many resources available to help. These include tax preparation software, online tax calculators, and the IRS website, which offers helpful tools and information for taxpayers. You can also seek guidance from a certified public accountant (CPA) or tax professional if needed.

Conclusion:

Filing taxes may seem like a daunting task, but with the right tools and understanding of the process, it can be manageable. Remember to gather all necessary documents, choose the correct tax form, and review for accuracy before submitting your return. If you need help or have questions, don't hesitate to seek assistance from available resources. By staying on top of your tax obligations and being proactive in managing your taxes, you can ensure a successful and stress-free tax season. So, make sure to start gathering your documents early and stay informed about any changes in tax laws or deadlines. With proper planning and attention to detail, filing taxes doesn't have to be a daunting task but rather a necessary responsibility for all taxpayers.